When life throws you a curveball it’s Swoosh to the rescue

Need cash, fast? Swoosh offers easy and quick cash loans, even for those with bad credit. No hidden fees or early repayment charges – just financial help when you need it most.

Your trusted small loans lender

Am I eligible for a Swoosh loan?

At Swoosh, we keep things nice and simple. As long as you meet these four criteria, you can apply for a loan.

Be at least 18 years old

Permanent resident or valid visa holder of Australia

Own a vehicle registered in your name

Employed for at least 3 months

Apply online in minutes with no application fees

Want to chat to someone?

Use our live chat or fill out the contact form to get in touch with a Swoosh Finance specialist

The Swoosh difference

Our Cash Loans are available when you’re in a pinch — and we work hard to make it happen fast.

We put you first, ensuring you have all of the information upfront.

Swoosh Cash Loans give you the funds you need now from a lender you can trust.

Why Aussies are choosing Swoosh

How long will it take for my loan to be approved?

Approval of your loan is provided within minutes of you providing the required information (during business hours)*. The decision will arrive promptly – right in your inbox.

Can I get a Swoosh loan with bad credit?

Yes, it is possible for you to receive a secured loan with bad credit at Swoosh. We look at the ‘here and now’ of your financial situation, assessing everyone on an individual basis. We want you to receive the assistance you need, so we look at more than just your credit history.

We offer online cash loans after evaluating current bank statements and, assessing whether the applicant has the ability to repay the loan. This way we are comfortable offering bad credit loans to those who have been impacted by their past, getting them the cash they need.

How much does it cost?

We’re transparent with our fees. There are no hidden fees, so you can make the best decision. Find out more here: Payday loans rates and fees

How do I receive my funds and how long will it take?

Your funds will be dispatched within one business day of signing your contract, Swoosh will electronically transfer your funds into your bank account.

If you return your signed contract by 3:30pm (AEST) time, your funds will be transferred overnight.

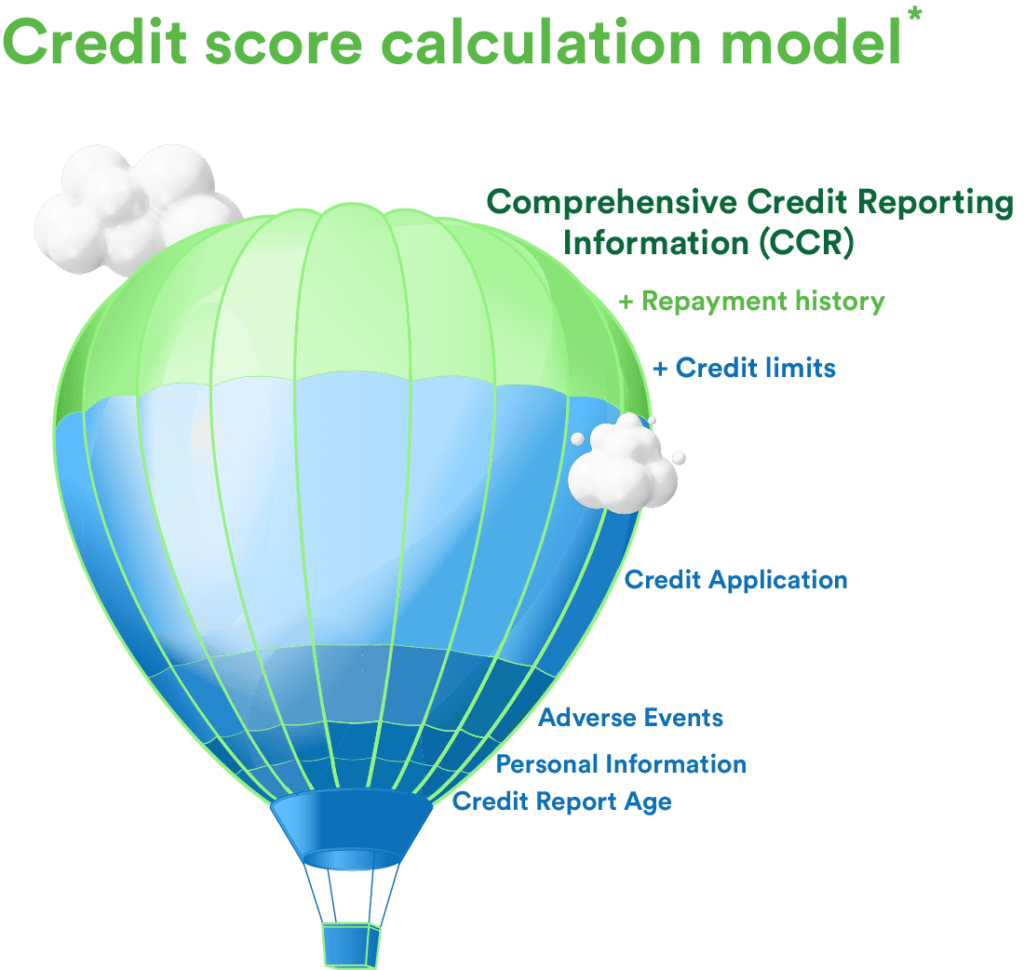

Learn how a personal loan could help improve your credit score

Personal loans impact specific parts of our credit history. We cover all the info you need to know how to use a personal loan to help improve your credit score.

Read more: Should you get a personal loan to improve your credit score?

*Based on Equifax scoring model. Scoring models can be subject to change and differ between agencies.

Swoosh Money Blog

Ready to get your loan?

Whether it’s for an unexpected bill, a last-minute holiday, or to consolidate existing debt, give yourself a break and apply now with Swoosh.